Cryptocurrencies have revolutionized the financial landscape, offering new opportunities for investors and traders. However, one of the main challenges in the crypto world is its inherent volatility. In this article, I will delve into the various aspects of cryptocurrency volatility, the factors contributing to it, and how artificial intelligence (AI) can help manage and navigate this volatile market.

Understanding Cryptocurrency Volatility

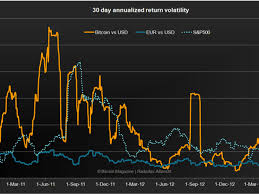

Before we explore the role of AI in cryptocurrency trading, it is essential to understand what volatility means in this context. Volatility refers to the rapid and significant price fluctuations that cryptocurrencies experience within short periods. Unlike traditional financial markets, where relatively stable assets exist, cryptocurrencies are highly susceptible to price swings due to their limited market size and speculative nature.

Cryptocurrency prices are influenced by various factors, including market sentiment, regulatory developments, technological advancements, and economic indicators. It is crucial for traders and investors to grasp the dynamics of these factors to make informed decisions and mitigate risks associated with volatility.

Factors Contributing to Cryptocurrency Volatility

There are several factors that contribute to the volatility of cryptocurrencies. Firstly, the absence of a central regulatory authority makes the market more susceptible to manipulation and speculative activities. News events and rumors can significantly impact the prices of cryptocurrencies, leading to sudden price spikes or crashes.

Secondly, the relatively small market size of cryptocurrencies compared to traditional financial markets amplifies the impact of buying or selling pressure. A large sell-off or influx of new investments can significantly impact the price of a cryptocurrency, making it prone to sharp price movements.

Furthermore, the lack of liquidity in some cryptocurrencies exacerbates volatility. Illiquid markets are more susceptible to price manipulation and sudden price movements. Additionally, the presence of high-frequency trading (HFT) algorithms further intensifies volatility, as these algorithms can execute trades at lightning-fast speeds, taking advantage of price discrepancies.

The Role of Artificial Intelligence in Cryptocurrency Trading

Artificial intelligence has emerged as a powerful tool in the world of cryptocurrency trading. AI technologies, such as machine learning and natural language processing, have the capability to analyze vast amounts of data and extract valuable insights. These insights can then be used to make data-driven trading decisions and predict market trends.

AI-powered trading algorithms can analyze market data in real-time, identify patterns, and execute trades accordingly. These algorithms can process information faster than humans, enabling them to capitalize on short-term price movements and take advantage of profitable trading opportunities.

Moreover, AI can help traders automate their trading strategies and execute trades with precision. By removing human emotions and biases from the trading process, AI algorithms can make objective and rational decisions based on market data and predefined rules.

Benefits of Using Artificial Intelligence in Cryptocurrency Trading

Utilizing artificial intelligence in cryptocurrency trading offers several advantages. Firstly, AI algorithms can analyze vast amounts of data from multiple sources, including social media, news articles, and market data, to identify patterns and trends that human traders might overlook. This allows for more accurate predictions and better-informed trading decisions.

Secondly, AI-powered trading algorithms can execute trades at lightning-fast speeds, taking advantage of even the smallest price discrepancies. This speed gives AI algorithms a competitive edge in the market, allowing them to secure profitable trades that might be missed by human traders.

Furthermore, AI algorithms can adapt to changing market conditions and adjust trading strategies accordingly. This flexibility enables AI-powered trading systems to navigate through volatile market conditions and minimize potential losses.

The Best Artificial Intelligence Tools for Cryptocurrency Trading

Several AI-powered tools have emerged in the cryptocurrency trading space, offering advanced features and functionalities to traders. One such tool is “ABC Trading Bot,” which utilizes machine learning algorithms to analyze market data and execute trades automatically. It offers customizable trading strategies and risk management features, making it suitable for both experienced and novice traders.